- RECONCILE FUNCTION QUICKEN FOR MAC 2016 HOW TO

- RECONCILE FUNCTION QUICKEN FOR MAC 2016 DOWNLOAD

- RECONCILE FUNCTION QUICKEN FOR MAC 2016 FREE

So what I would say, is that it may take quite a bit of time and effort to PROPERLY learn how to use Quicken, and setup all of your accounts, customize reports, get everything organized, etc. There is no way I could do (or would want to do) all of this in an excel spreadsheet. *And a whole host of other reports I've customized over the years, such as after-tax spending analysis, fair value of home equity/invested capital, investment account performance, etc. *Cash flow forecasts for monthly bills or other expected costs to hit the checking account, allowing me to plan and forecast savings transfers to investment accounts and make adjustments for any unusual or one-off expenses coming up (no other platform does this so seamlessly, AFAIK). *Updated tax liability projections, which is helpful for adjusting tax withholdings (not perfect, but it helps flag potential problems to investigate)

RECONCILE FUNCTION QUICKEN FOR MAC 2016 FREE

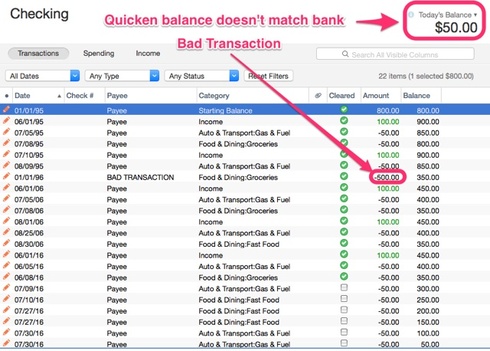

*Updated free cash flow results, on a monthly and year to date basis Every day, with usually no more than 5 minutes of work, I can get: Fairly easy to do if you have 23 years of tax returns handy.but much easier in Quicken.Īll that being said, I am a numbers and stats kind of guy but I wouldn't die without Quicken.įor me, running Quicken allows me to run the family finances as if we were running a business. Recently I was trying to determine the contributions to my Roth IRA (vs gains). There are many other things that I use it for on a lesser level. Finding out when I replaced XYZ or bought ABC Quickly finding fraudulent/erroneous transactions (due to the downloads) Tracking investment performance over different periods of time Tracking net worth and investment totals over time Tracking spending over different categories over different periods of time Pay any bills (through my bank) that aren't on autopay. The things I find Quicken most useful for: The only thing I manually enter is cash transactions and I rarely use cash.

It takes a couple of minutes to do that and make sure the categories are correct and there are no fraudulent transactions.

RECONCILE FUNCTION QUICKEN FOR MAC 2016 DOWNLOAD

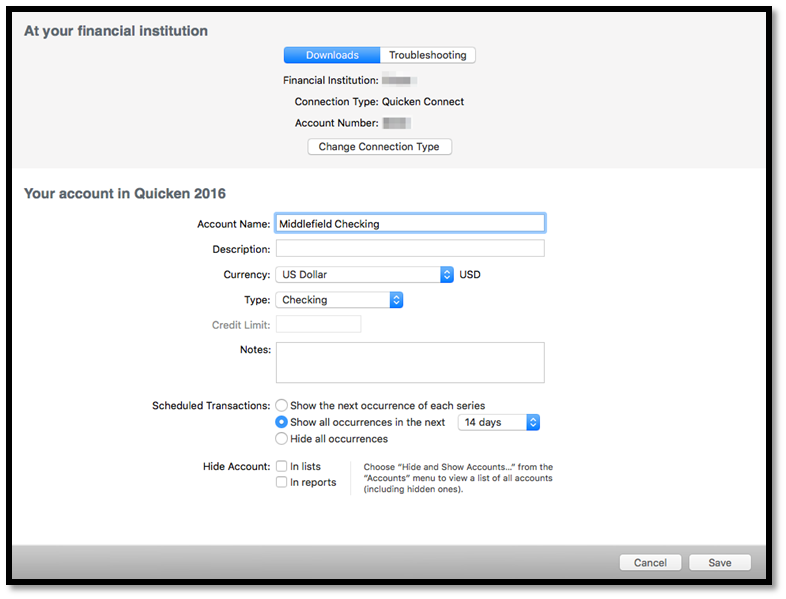

I download all my transactions (checking account, 4 investment accounts, +or- 5 credit cards, etc) a few times a week. I have used Quicken for around 25 years and find it valuable. I guess you can track your net worth over time. For example, if you took $3k of the $5k and paid off debt you are in the same position essentially even though balances are changing. What is the value of knowing what your checking account balance was each month? Without context, I don't see the usefulness. So if I have $5k in checking, I put that in the spreadsheet. I just look at what my balances are and input them in the spreadsheet. But once you assign the “Food” category to “XYZ Grocery Store,” Quicken will remember that category every time you download a transaction from that store in the future. There is some upfront work to get the categorues set up, although Quicken does have generic ones that you can use. Quicken makes it simple to download transactions and assign budget categories. I’m having trouble envisioning how your spreadsheet tracks balances if you don’t input transactions. I do not find Quicken to be very useful for Boglehead style asset allocation and rebalancing across many different accounts. Since the cost is $52/year (less if discounted) it won't break the bank to try it and see if you like it given you don't want to use online services. Some people won't have patience for this.

The name of the report might not match what you actually want to see. You want to find a report that has the right fields and then lets you filter or sort as you need to. Sometimes you have to search and experiment to find the right report you want to start with. Reporting tools are not modern but they are customizable. If you don't want to invest that time to customize it and learn the features it may not be a good choice. I do track transfers from income and spending accounts to investing accounts and use that as one of my primary benchmarks year to year.Įven after almost 25 years I can sit down with Quicken for 2 hours and learn new things about how to use it. Although I don't budget I do once or twice a year run a spending report so I can see where money is going or compare to prior year.

I add notes like "Accord battery" or "master bath toilet" or "darn tough socks" to aid with searching. To do that you have to keep up with data entry even if you download transactions from your banks. I do use it to search old transactions (like when did I buy batteries for the cars and when did I replace the toilet). I've used Quicken for almost 25 years, but its definitely a personal preference not mandatory.

0 kommentar(er)

0 kommentar(er)